Create a tax entry in your Tax Table

If you are required to charge tax on products and services, you can set up a tax table for use on order entry, subscription forms, and eCommerce orders. Depending on your setup, tax rates will either be automatically selected on order entry or manually specified by users when creating orders. If creating tax tables for shipping subscription or E-Commerce orders, the system will use a customer’s shipping address to calculate the tax rate. Each state can have a tax rate for every product type.

To manage Tax Tables, go to Settings > Billing > Tax Tables. To access this page, you must have the User Permission 'Tax Tables'.

If you only have one tax rate that will be used throughout the site, then rather than setting up tax tables, go to the System Configurations and add a default tax rate. The system will always use this tax rate when entering a print, digital, or service line item.

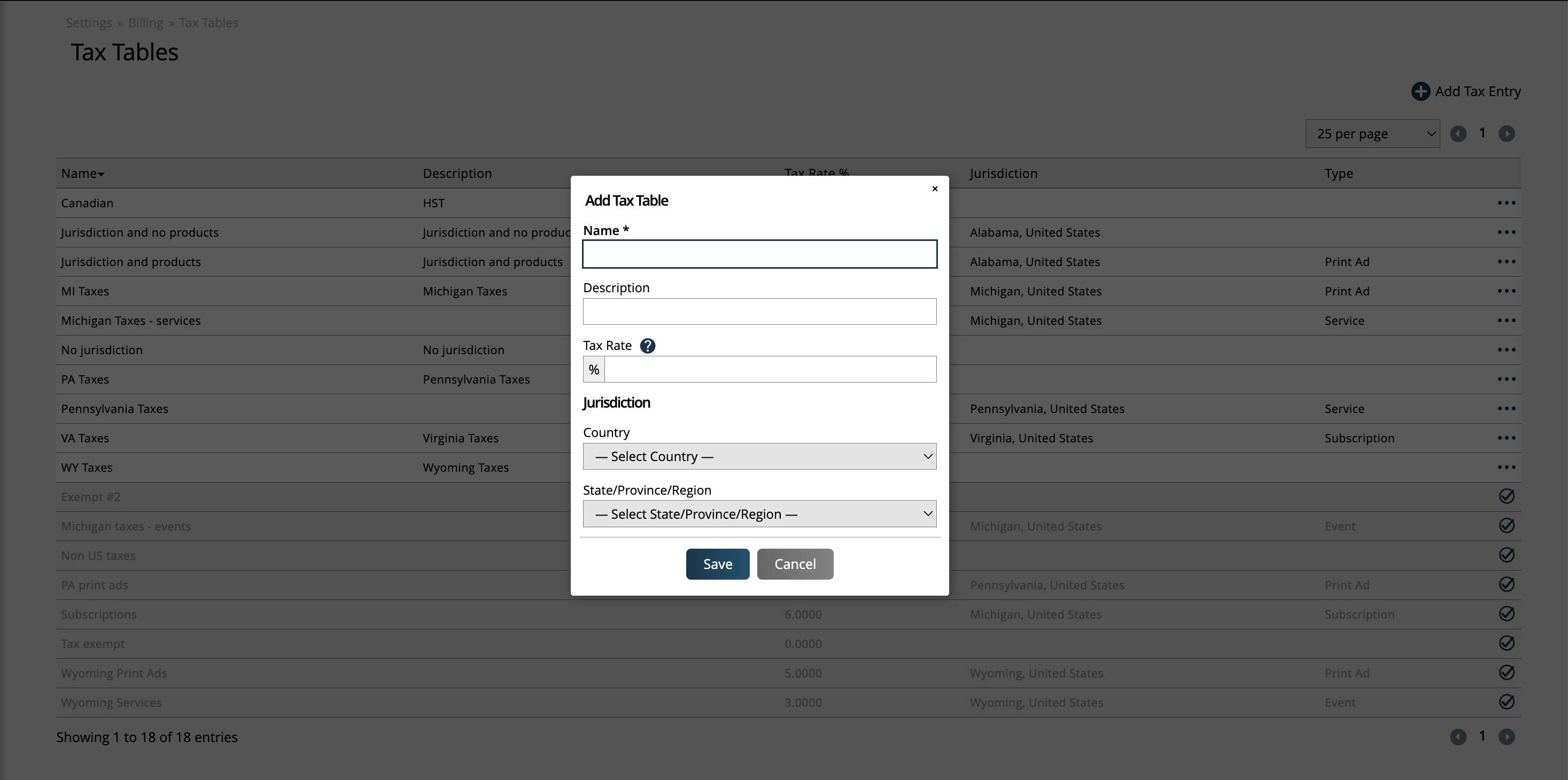

To create a new entry, click the 'Add Tax Entry' button.

In this popup, determine your tax entry settings. Every tax table requires a name. You can also enter a description if desired.

The Tax Rate field is percentage based. Enter a number value between 0 and 100 to use as your tax rate for the entry.

The Jurisdiction fields are optional, and will change how the tax entry is used within Ad Orbit.

Entries without any jurisdictions entered can be used on standard Ad Orbit orders. These items can be selected on the add/edit line item popups on orders.

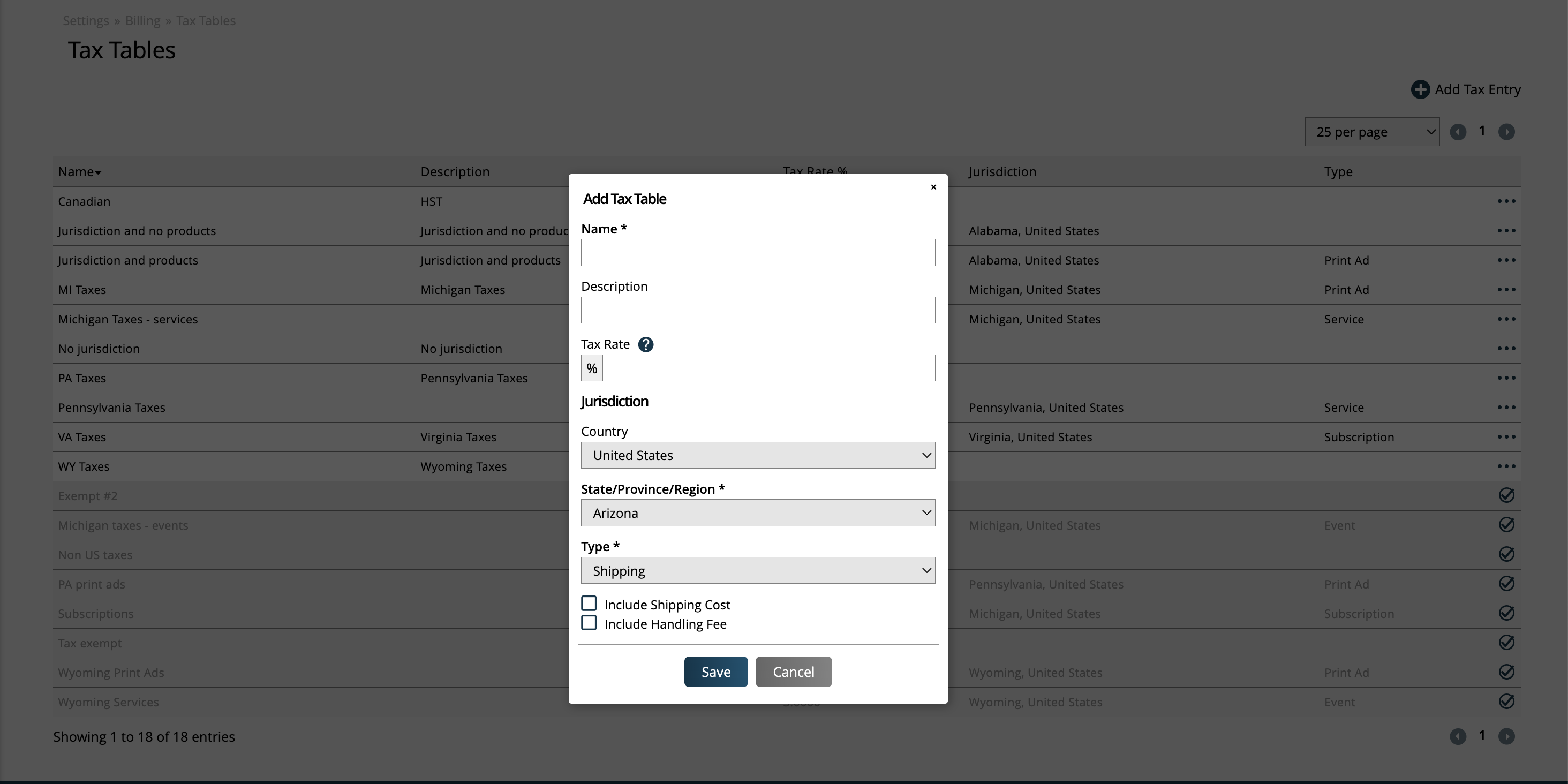

If a jurisdiction is entered, then there will be an additional 'Type' field.

The 'Shipping' type is used to tax shipping on E-Commerce orders. When you select Shipping, you can choose to tax the shipping cost, handling fees, or both.

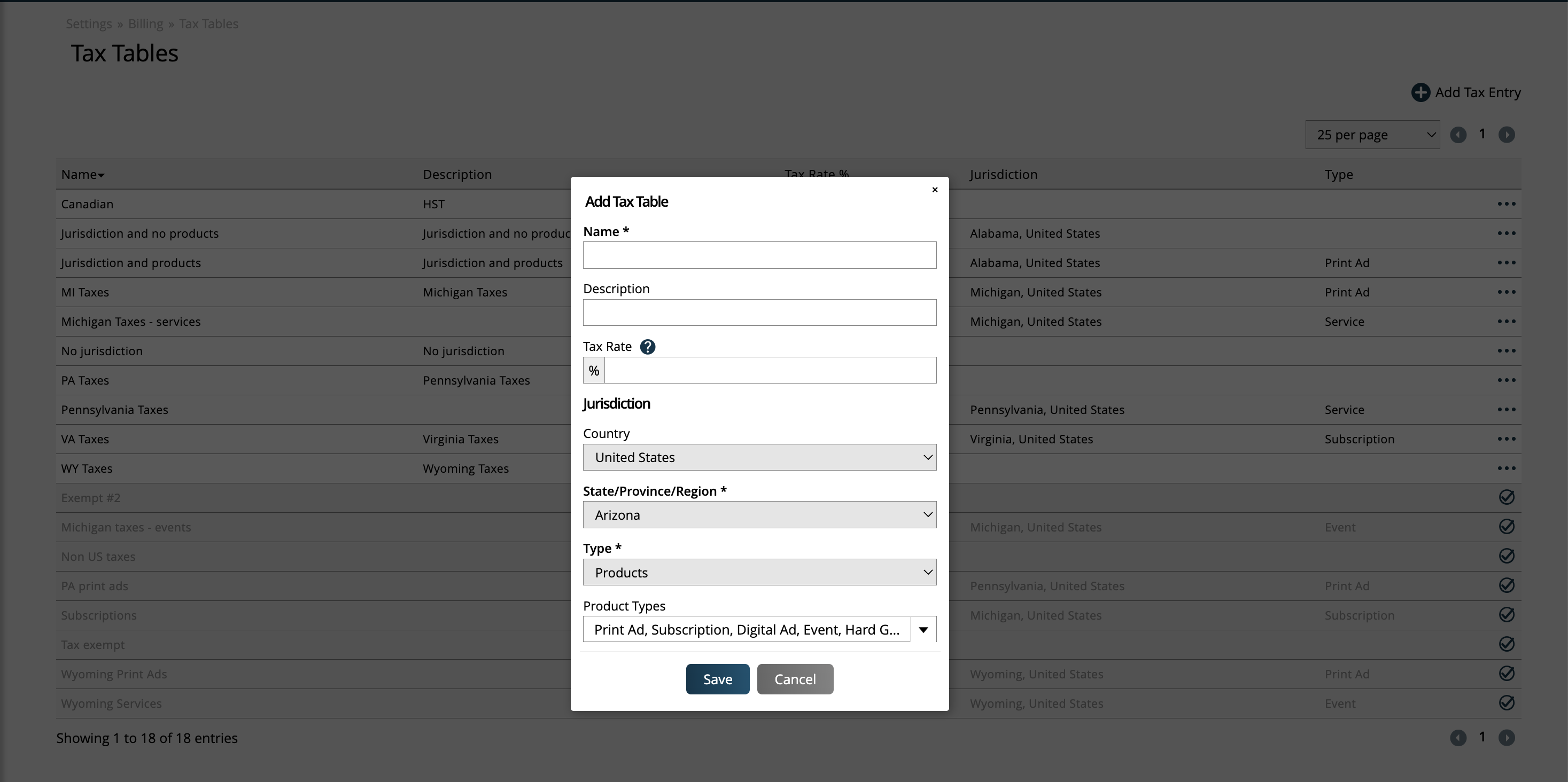

When the 'Product' type is selected, you can choose which products to apply the tax rate to.

Important

If you want to use the 'Product' type for standard Ad Orbit orders, then select the 'Product' type, but do NOT select any of the Product Types in the dropdown.

To set up a tax rate for consumer orders, e.g, subscription sales, you must select a jurisdiction and product(s). The system will use the customer’s shipping address to determine the appropriate tax rate. In this case, any product can be used.

When a tax entry is set up with a jurisdiction and the 'Product' type but no products selected, these entries can be selected on standard Ad Orbit orders as well, and can be used in the add/edit line item popups on orders.

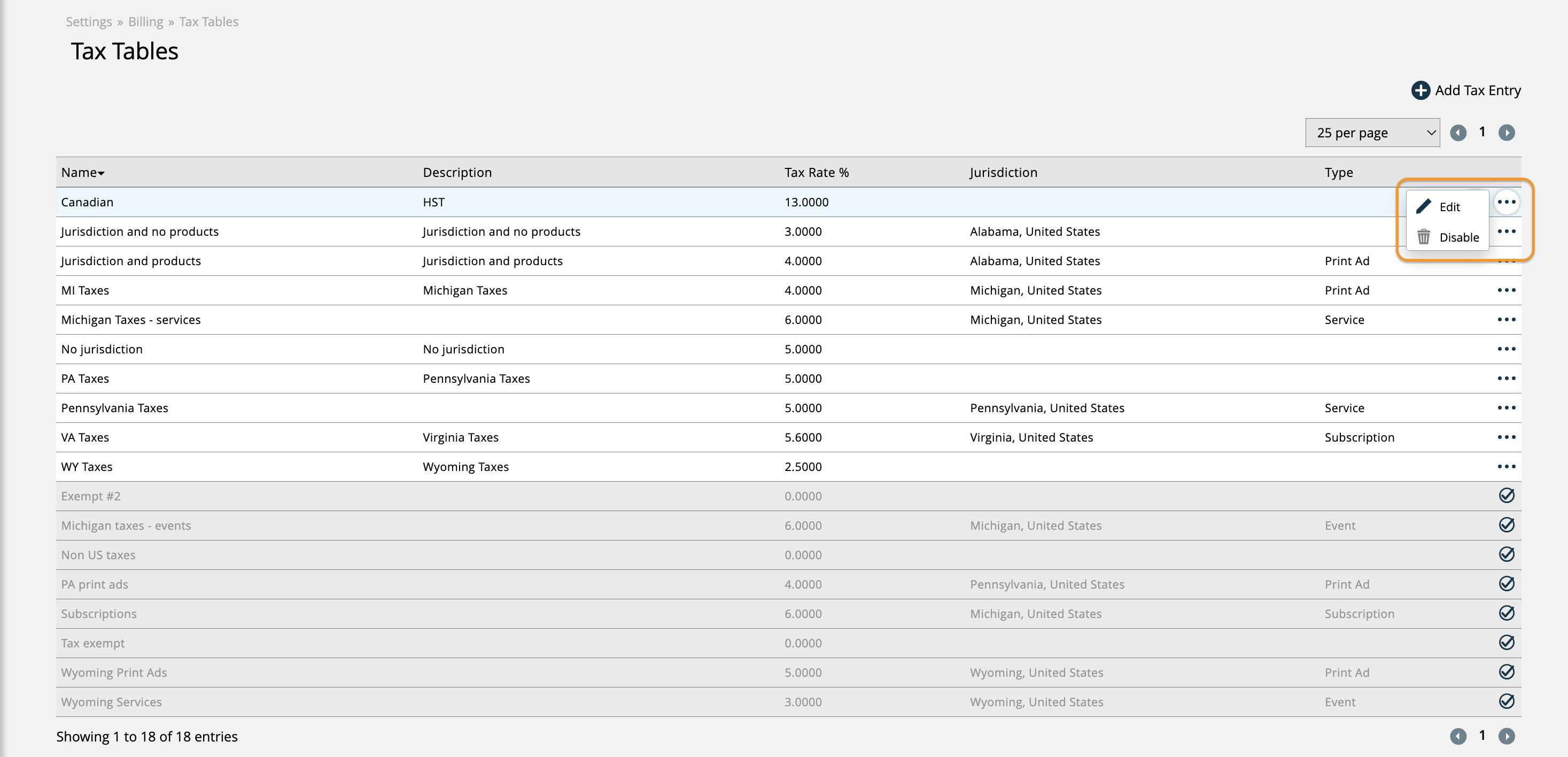

Existing tax entries can be edited, disabled, or re-enabled by using the ellipses action on the right side of the table. Any disabled entries will be grayed out.

Updated 10/9/2025